Aan Tiwari honoured with Best Child Actor award for Baal Shiv

Aan Tiwari honoured with Best Child Actor award for Baal Shiv Ghategi rahasymayi ghatnaye!

Ghategi rahasymayi ghatnaye! Amazon Prime Video unveils the 2021 Festive Line-up; brings a heady mix of Indian and International titles on the service

Amazon Prime Video unveils the 2021 Festive Line-up; brings a heady mix of Indian and International titles on the service Release: Music video of, Yeh Haalaath, from Mumbai Diaries 26-11

Release: Music video of, Yeh Haalaath, from Mumbai Diaries 26-11 Bhumi Pednekar feels she shares feel-good value with Akshay Kumar on screen

Bhumi Pednekar feels she shares feel-good value with Akshay Kumar on screen

OTTs take the 'right' route to filmy biz

Remember the days when you used to wait for a big Bollywood blockbuster to premiere on the small screen? Long gone are those days with the OTT platforms breaking the pattern, and bringing in a shift in the viewing habits.

The sale of digital rights has turned out to be a big contributor in the business of the entertainment industry. Producers are increasingly going the virtual way, beyond the traditional selling of satellite rights when it comes to home viewing. But are they disrupting the trade? Not at present, but the threat looms large.

Theatrical release still holds the big share of the revenue pie, followed by satellite rights. But acquiring digital rights might eclipse the figures sooner than expected.

According to KPMG's Media and Entertainment report this year, "the economics of film production has undergone an overhaul as digital rights have tilted the dynamics of film making in favour of production studios".

It is also turning out to be another source of revenue for filmmakers, and another avenue for the audience.

"Earlier, satellite companies used to buy all the rights and digital rights. Now, digital companies are coming and buying the rights. I don't think they are disrupting. They are adding another revenue stream for the producers to make money. It is a win-win situation for all," film and trade expert Girish Johar told IANS.

The entry of OTT players, however, is initiating change in the pricing of cable and satellite rights.

According to the 2019 edition of the FICCI-EY report, 2018 saw digital rights "driving up the cable and satellite prices of tent pole movies".

"With consumption of content on OTT platforms set to increase in the future, digital rights values of films will continue to increase. Competition of digital rights is likely to get more intense with Jio likely to play an aggressive role either with partners Eros and Balaji Telefilms, or on its own," stated the report.

Pointing at an important factor, trade expert Vinod Mirani told IANS: "OTT is not restricted to your phone, you can connect it to your TV and that nullifies satellite to some extent. But then, there are so many OTT platforms now, how many can one subscribe. They are competing with each other and killing each other's potential."

The KPMG report also highlighted that the OTT platforms are investing heavily in acquiring film libraries, stating that Amazon Prime acquired the digital rights for 12 films out of the highest 30 grossing Hindi films this year, followed by Netflix which acquired nine, ZEE5 acquired eight, Hotstar three and others two.

When it comes to Amazon Prime Video, the streaming giant has content deal with Yash Raj Films, Dharma Production, Salman Khan Ventures, Excel Entertainment and T-Series.

Globally popular Netflix has a deal with Shah Rukh Khan's Red Chillies Entertainment. They have popular films such as "Andhadhun", "Hamid", "Nathicharami", "Article 15", "Ek Ladki Ko Dekha Toh Aisa Laga", "Luka Chuppi", "Stree", "Badla", "Zero" and "Kabir Singh" added to the catalogue.

"There is almost a gap of eight weeks before you can move a film to the satellite or digital platform, after its cinema release. Each film has different range, some work in cinemas, some on the small screen and some on OTT platforms. The price of rights depends on how they view the film as. Like ‘De De Pyaar De' worked well at the box office, but not at satellite channel," trade expert Rajesh Thadani told IANS.

The virtual world might be weaving a web in urban India, but small screen is still a big deal for the masses. The tradition of families getting together on a Sunday, or a public holiday, to watch a film, continues to live in India, and so is the love for larger-than-life stories.

That's proved by the viewership data from the television premiere of movies such as "Total Dhamaal", "2.0" (Hindi), "Kesari", "Luka Chuppi", "Junglee", "Simmba", "Zero", "Kedarnath", "Race 3" and "De De Pyaar De".

It is also reflected in the deals between the production houses and channels. For instance, the satellite rights of Amitabh Bachchan and Chiranjeevi's "Sye Raa Narasimha Reddy" has reportedly been acquired by Zee Network for Rs 125 crore, making it the highest for a south Indian film.

Before it performed below expectations at the box office, the satellite rights of Prabhas' "Saaho" were acquired for an amount of Rs 320 crore. The film is rumoured to have been made at a budget of RS 350 crore. Kangana Ranaut's historical "Manikarnika: The Queen Of Jhansi" reportedly secured a deal by selling digital rights at Rs 40 crore and satellite rights at Rs 20 crore.

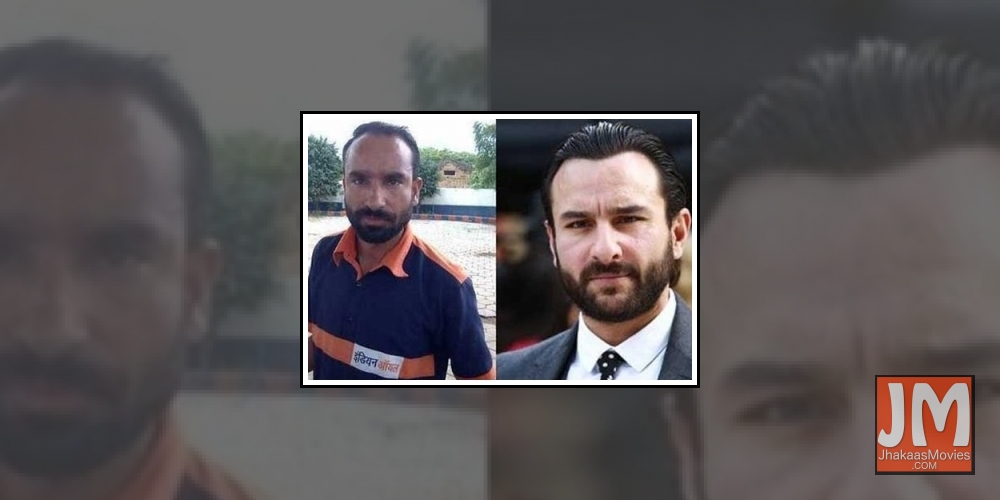

In the past, the satellite rights of Sanjay Leela Bhansali's historical "Padmaavat" were sold for Rs 80 crore, and Rajkumar Hirani's "Sanju" fetched Rs 50 crore. Salman Khan's "Race 3" got over Rs 100 crore for satellite rights, Saif Ali Khan's "Kaalakaandi" made up its money by selling satellite rights around Rs 11 crore. Akshay Kumar's inspiring "Padman" was sold at Rs 47 crore, "Aiyari" at Rs 25 crore and Anushka Sharma's scary affair "Pari" at Rs 10 crore. The makers of "KGF" sold Kannada and Hindi satellite rights for Rs 30 crore.

It is believed that Yash Raj Films sold satellite and digital rights of "Thugs Of Hindostan" to Sony Pictures Networks and Amazon Prime Video respectively for Rs 60 crore and Rs 70 crore each. There are reports indicating that the digital rights of "Sanju" were sold for Rs 20 crore and "Padmaavat" somewhere between Rs 20 - 25 crore.

Only time will tell whether satellite channels can survive or get wiped out in the OTT.

(Sugandha Rawal can be contacted at sugandha.r@ians.in)

OTTs take the

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.

OTTs take the 'right' route to filmy biz.